Investment Art

Visual Arts Evaluation System

For over half a century, the Gostev dynasty has adhered to a specific system of evaluating visual arts. When we talk about investing in visual arts, we imply an obvious sequence to us:

- Investment in the emotional state from contemplating and possessing a work of art—cultural and aesthetic value.

- Financial investment in visual arts as a capital investment—potentially high returns.

There is a significant difference that sets Gostev's evaluation apart from other auction houses and art sales platforms where well-organized marketing allows a banana on a wall to be declared a work of art.

Over three generations, we have learned investment evaluation of artworks based on a combination of several factors and according to our own rules.

1. Artistic Literacy.

If a person dedicates their life to artistic creativity, gives all their time to it, they learn the craft in the process, become interested in artistic literacy, and develop as a craftsman. A master of artistic craftsmanship is capable of conveying any image while respecting the laws of composition, color theory, and perspective. They can detail an object on canvas or in sculptural form.

Examples of Artistic Literacy.

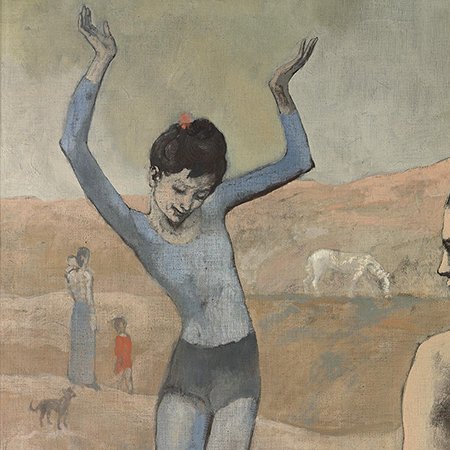

Look at the works of ancient masters of painting and sculpture. During the Renaissance, an artist was defined by their skill in accurately conveying details. Or take note of the early works of Pablo Picasso. Are the body proportions of the Girl on a Ball distorted, or is the composition of the painting flawed? Is there any evidence of poor paint mixing in Van Gogh's paintings?

This is mastery of the artist's craft. After this stage, the artist has the right to paint an eye on an ear or twist the sky into spirals. But not the other way around.

Craftsmanship does not determine the investment value of a work of art, but it is a necessary prerequisite for the second rule.

2. Emotional Fabric.

There are four types of activities that justify human existence on this planet: music, literature, painting, and cinema.

Music, literature, and cinema are constantly changing emotions throughout a work. Painting is not. Painting is a can of emotions. Painting collects the thoughts and feelings of the artist, concentrating them into one emotional image. And it gives it back to the viewer—whole and immediately. In the emotion of painting, there is no movement; it contains everything at once.

Example of Investment Art.

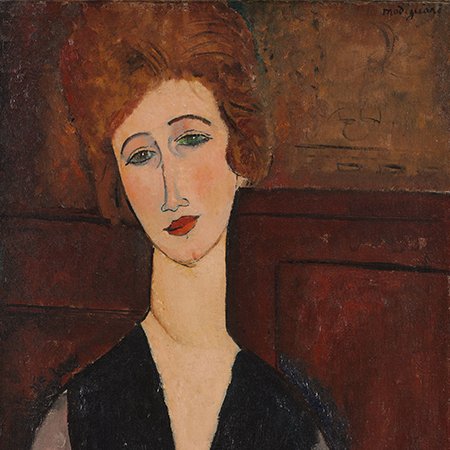

You look at a painting, and it moves you immediately and entirely; you feel what the artist felt, you understand the essence of his thoughts. The artist thought about the beauty of the landscape - you admire the beauty he saw. Modigliani admired the beauty of women, and we feel and know that they are beautiful.

This is investment art. It contains thought, emotion, and message. The more beautiful, powerful, and pure the emotional message, the higher the investment value of the artwork.

Set of Investment Art Factors

A musician cannot play without knowing how to play. A musician cannot play beautifully if they know the notes but don't know what to play. Thus, craftsmanship gives freedom to the expression of emotion, and the beauty of emotion creates a masterpiece. The example of Picasso, Van Gogh, and Modigliani clearly shows the combination of craftsmanship, the desire to be an artist, and to create paintings with emotion throughout their lives.

Authoritative Art Investment Evaluation

The method for evaluating paintings, artists, and art investments is masterfully described in Anatoli Gostev's articles— "Owning a Painting" and "The Destruction of Spirit in Art" (links at the bottom of the page). This is a pure method, free from marketing and deception. It's an important topic where, through the development of artistic taste, analysis of artistic literacy, and emotional impact of the work, the essence boils down to an intuitive inner hint.

One must understand that Painting is a level of perception where market-based relations are unacceptable. I often hear: "I don't understand anything about paintings, but I really like this one." That's correct—your soul gave you the right choice. And who understands painting better than your soul?

You need to firmly understand that the investment value of a work of art is not determined by PR. A banana on the wall costs a dollar twenty, a canvas splattered with paint from a bucket does not exceed the price of the canvas and the cost of the paints, the author is a clever marketer, the buyer's motivation is unknown, but one thing is certain—this is not an investment and the buyer is not an investor.

You can send a work for an unbiased evaluation to us (see Art-Promoter menu). In the Gostev's dynasty, all artists have a highly developed taste and understanding. We will not only give our "like or dislike" opinion, assess the artist's level and provide an approximate evaluation, but also offer various development and perspective options. At the end of the article, we present a number of facts that may motivate you to invest in visual arts. Happy investing.

Cultural and Aesthetic Value

Investing in art not only brings financial benefits but also allows you to enjoy the aesthetics and cultural value of the works. Owning a unique piece of art can provide moral satisfaction and status recognition.

If you bought a painting that you like, you will always have a painting that you like.

Heritage and Wealth Transfer

Artworks can be passed down through generations, allowing family wealth to be preserved and multiplied.

Supporting Artists

Investing in contemporary art also means supporting young and talented artists. It's important here to distinguish between an artist and a marketer.

Long-term Value Preservation

True works of art eternally preserve the thoughts, strength, and energy of the author, becoming part of cultural and historical heritage.

Potentially High Returns

The value of artworks, especially those by well-known masters, tends to increase over time. Historical data shows that some artworks yield significant profits, especially if they were purchased at a good price.

Portfolio Diversification

Investing in art allows for portfolio diversification, reducing risks associated with traditional assets. The art market often behaves independently of the stock market, making it attractive for those looking to reduce their portfolio's dependence on the volatility of other assets.

Inflation Resistance

Art is often seen as a defensive asset that retains its value even in times of high inflation. Unlike other financial assets, paintings and sculptures can maintain or even increase in value.

Limited Supply

The supply of artworks is limited. This creates demand for these items, which over time increases their value, making them stable and reliable long-term assets.

Ownership of an artwork

Ownership of an artwork Destruction of the Spirit in Art

Destruction of the Spirit in Art Art inspiration

Art inspiration Contemplation of painting

Contemplation of painting